User-friendly & time-saving

Automated Expense Report Processing with JobRouter Digital Process Automation

Before switching to JobRouter®, Metzler was already using a program for electronic expenses accounting. The disadvantages with the existing system were significant however. They ranged from the high cost that went into configuring the program to its handling (which was not user-friendly) and the high license fees per settlement. Since Metzler was already using the JobRouter® digital process automation platform successfully for various other processes, the decision was taken to move the expense accounting process to JobRouter®.

A workflow that meets the special requirements

Alongside improving user-friendliness, the aim was to reduce the costs for maintenance and operation and to adapt the general process structure, but especially to save time for acquisition of approvals, and for Administrative Accounting.

This required a system that can be flexible and capable of being configured and administrated in-house. In addition to the requisite standard functions (requirements from fiscal administration), there was also a need for individual arrangements to be specified, such as a minimum amount per expenses payment. Where the old system only permitted recording and subsequent posting by Administrative Accounting, the new process was to be backed by a workflow reflecting the company’s unique requirements and capable of being adapted at any time.

Since Metzler was already successfully using the JobRouter® digital process automation platform for various processes, it was decided to use JobRouter® to handle expense reporting as well. In addition to relieving the financial accounting department burden, an expense report should also be as simple as possible for the person submitting the expense.

Advantages

Benefits for management

- Cost savings compared with the old system

- Documentation and tracing of all activities

- Secure archiving and fast access to documents

- Minimizing sources of error

- Improved process quality

- Higher employee satisfaction

- Timely processing

- Control and transparency

- Reduced throughput times

- Reduced administrative effort

Advantages

Benefits for employees

- Simplified expense recording

- Stored help instructions directly in JobRouter®

- Time savings

- Fast further processing of expenses claims

- Visibility of status

Project details

- Client

- Metzler Bank

- Industry

- Banking/Finance

- Employees

- Approx. 750

- Instances

- Approx. 100,000 p.a.

- Database

- Oracle

- Ongoing processes

- Accounts Payable processing, Sales invoice processing, Expenses accounting, Debit notes, Sales invoice cancellations, Staff admin, Accounting processes, Archiving workflow

- Planned processes

- /////////////// Special features: EASY archiving system transactions: more than 100,000 annually

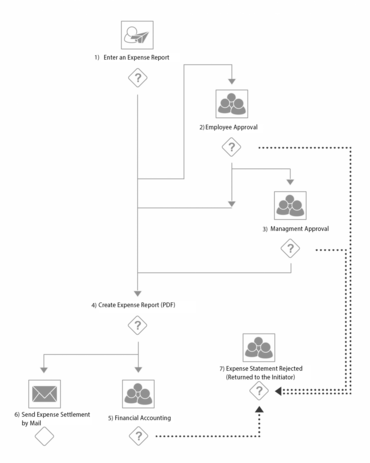

The expense report process flow

An expense report process can be launched by any employee, using “Create expense account”. This allows the employee to record expenses for themselves or, depending on the internal departmental arrangements, for other colleagues.

Simple reading of receipts

First, the start and end of the trip are selected by calendar and the purpose and destination are entered in a free text field. The expense items to be entered are divided into expense categories. General expenses, hospitality, gifts, hotel costs, mileage, accommodations, and meals per diems are available. Depending on the previously selected expense category, a selection list of expense types is available in a further column. For example, in the expense category "General Expenses" you can choose between taxi, train, flight etc..

The contents of the selection lists were defined on the basis of Metzler's special requirements. Different data must be entered according to the expense category, therefore an individual entry list was created for each category and corresponding mandatory fields were defined. In the expense detail fields, information such as amount, miles traveled, expense allowances, and currency etc. can be entered. In the case of foreign currency, the refundable amount is automatically converted using a stored exchange rate.

In the data entry dialog and in the input screens for the individual expense categories, the person entering the data is offered context-related instructions and help documents, such as extracts from legislation, internal work instructions and user manuals.

These can be looked up if, for instance, an employee is uncertain about the correct expense type or category, or they wish to know how and in what order the data entry dialog needs to be completed. If the data entry is not made by the business traveler themselves but, made by an assistant, the traveler receives the expense account for checking and approval, in a separate process step.

Follow the rules with approval limits

Expense accounts below the authorization limit are directly passed to the administrative accounting. Expense accounts above the authorization limit first need to be approved by a line manager. If the account is rejected, the person recording the data receives the data entry dialog including a justification by the line manager, so that it can be corrected. Following approval by the line manager, the next stage is for the accounts to be forwarded to Administrative Accounting. Before the expenses account is passed to Administrative Accounting, a cover sheet is generated automatically with a summary of all statement dates and items and details of the recorder, traveler and line manager, as a PDF which is sent to the recorder by e-mail.

Checking receipts

A print-out of the expenses account has to be submitted to Administrative Accounting for checking, together with all receipts. Submission of the original receipts is a pre-requirement for the accounts to be checked by Administrative Accounting. Expense accounts that have been checked and approved are automatically transferred into the bookkeeping system and shown for payment.

In the event of non-approval of individual items or of the whole account, Administrative Accounting can select the relevant message from a predefined list of error messages. After this, there is a stage where the expense account is returned to the recorder, who must either complete or correct the account. This process loop is runthrough until all checks by Administrative Accounting are successfully completed. All data and receipts submitted can then be archived in the archiving system.

Using a search function, any employee can inspect the status of current or processed expense accounts at any time.

Short profile - Metzler Bank

The limited partnership, B. Metzler seel. Sohn & Co., is a private asset management and investment bank based in Frankfurt, Germany and employs around 850 people. The 2017 annual report shows total assets of EUR 3.7 bn, with EUR 76 bn assets under management. The origins of the Metzler Bank go back to 1674. Founded by Benjamin Metzler as a trading company, it is the oldest and largest family- owned German private bank. Since 1971, Friedrich von Metzler has lead the bank as general partner in the 11th generation.