Increased efficiency, thanks to digital processes

Accounts payable automation

- Last updated , created on

- Reading time

- Category Document management

Much has changed in the workflow for processing incoming invoices thanks to digitization. Read this article to find out how to digitize incoming invoice processing, automate previously manual processes, and make the invoice verification workflow run smoothly.

What is an accounts payable workflow?

An accounts payable workflow is the route that an inbound invoice takes, from post office to accounting. In the past, this process was completely manual. These days, many companies are opting for digital accounts payable workflows for efficiency and transparency.

What are the benefits of digital accounts payable workflows or processes?

The advantages of automating the accounts payable workflow:

- Process and approve invoices faster

- No idle times or lost invoices

- Clear assignment to responsible persons

- Increased transparency

- Frees up personnel capacities due to less processing effort

- Take advantage of discount periods

- Reduce susceptibility to errors

- Spares the environment by using less paper

- Interfaces to ERP and financial accounting systems

- Employees can work from home

- Storage and archiving in accordance with GoBD guidelines

- Individually configurable

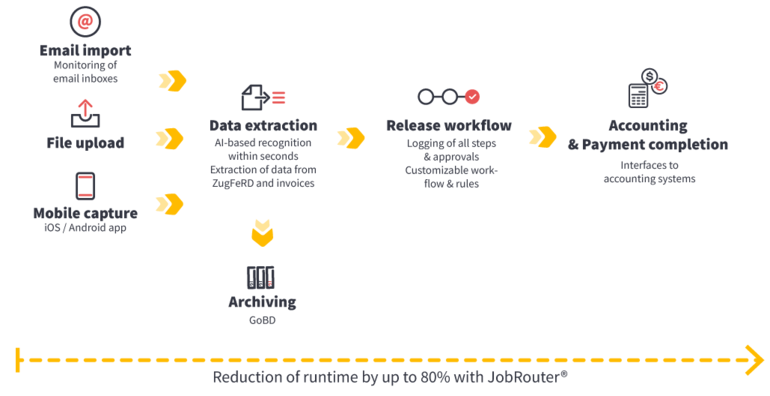

The advantages of digitalization do not only have a “stationary” effect, but also a positive impact on the overall profitability of a company. The following is a numerical example: A digital accounts payable workflow using the JobRouter® digitalization platform reduces throughput time by 80 percent.

Challenges in digitalizing accounts payable workflows

When it comes to digitizing accounts payable workflows, companies face several challenges:

- High proportion of paper documents

- Lack of technical capabilities

- Not enough knowledge of creating e-invoices

- Legal requirements that must be observed

- Different formats such as standard PDF, X-invoices, ZUGFeRD, XML, and EDI

Logging inbound invoices in various formats

The challenge is to log all inbound invoices, regardless of their medium and format, and to then make them available digitally for subsequent steps in the accounts payable workflow.

This requires a solution that can handle invoices from all input channels. In the case of PDF, paper, or fax invoices, automated data recognition using OCR (Optical Character Recognition) must be available. Ideally, the system not only recognizes and classifies incoming documents, but also extracts the contents.

Additional process improvements will result if the system also takes over the test in accordance with the provisions of the VAT Act as well as the initial calculation test.

Invoices received in ZUGFeRD format or via EDI are less challenging. Here, digitization solutions can read the content directly and transfer it into the subsequent process.

Systems that map the entire process flow

In conventional solutions from the fields of enterprise content management (ECM) and document management systems (DMS), the scope of services generally ends with digital delivery and digital archiving of documents. This enables compliance requirements to be met and revision security to be established, but the full potential for optimization is still not being tapped into.

If you have specified in your requirement definition that you not only want to digitize documents, but also automate process steps for accounts payable processes, then you need a holistic platform, that offers additional features.

A key function for automated accounts payable is, for example, automated invoice review. Modern platforms use artificial intelligence to do this. It learns to optimize results through manual corrections and thus continues to evolve. Over time, this type of software is therefore able to independently check incoming invoices with the highest accuracy.

It is also helpful if the solution used automatically captures detected invoice data and forwards the receipt to a predefined user for factual review. This user should be able to make queries, comments, and error corrections, all within the same system, to prevent media breaks and loss of information.

Legal requirements for digital accounts payable workflows

At the end of the digital accounts payable workflow, digital archiving takes place in line with legal requirements. The solution used should comply with the following regulations in particular:

- Commercial Code (§§ 239, 257 HGB, keeping of commercial books, storage of documents, retention periods)

- Fiscal Code (§§ 146, 147 AO, regulations for accounting and for records, regulations for the storage of documents)

- Principles for the proper maintenance and retention of books, records, and documents in electronic form, as well as for data access (GoBD)

In addition, workflow documentation is required for GoBD-compliant archiving.

The introduction of JobRouter® has enabled us to process incoming invoices faster and more efficiently and facilitated the control over the whole process.

Tobias Schwarz

Tobias Schwarz

Head of Accounting Division

AWO-Bezirksverband Braunschweig e. V.

How to make accounts payable workflows digital

You can customize the company’s in-house processes through innovative software, to establish automated accounts payable workflows. One or more interfaces enable straightforward interaction between the new software and your existing software (e.g., ERP, financial accounting, or merchandise management system).

The digital accounts payable workflow at a glance:

- Companies must first digitize an analog inbound invoice as a PDF, in order to make it accessible to digital processing. Digital accounts payable documents can be integrated automatically into the process using suitable software.

- Recognition software reads and checks all relevant invoice data – “incorrect” invoices are sorted out or can be manually corrected or edited afterwards.

- The correct invoices receive an automated “Go” and are forwarded for checking or approval to the responsible person or department.

- Through interfaces, it is possible to transfer the released invoices to an ERP, financial accounting, or merchandise management system system.

- All invoices can be properly stored in the digital archive in accordance with GoBD principles and can be called up to view again immediately.

- The system logs each step so that project participants can track the current status and the entire path of accounts payable workflows at any time.

Digital accounts payable workflows with JobRouter®

This is a YouTube video. When you play this video you agree to the privacy & terms of Google and you also agree to our privacy policy.

Time is money - that's also true when it comes to incoming invoice processing.

Try our JobRouter® digitalization platform now

Several aspects must be taken into account for successful accounts payable processing. These are implemented by the JobRouter® digitalization platform:

- All incoming invoices must be consistently digitized, in all formats

- Paper is eliminated from the process completely

- Seamless integration with existing systems

- High degree of automation

- Comfortable low-code platform

Try our JobRouter® digitalization platform now

Several aspects must be taken into account for successful accounts payable processing. These are implemented by the JobRouter® digitalization platform:

- All incoming invoices must be consistently digitized, in all formats

- Paper is eliminated from the process completely

- Seamless integration with existing systems

- High degree of automation

- Comfortable low-code platform

Maximize your success with digital accounts payable workflows

Using digital accounts payable workflows simply pays off. Your organization is making a decisive step forward, and not just in terms of digitalization. With an intelligently established digital accounts payable workflow, you benefit from more time and security, lower costs, fewer errors, better cash flow, more certainty, and greater agility.

Find out how you can digitalize your accounts payable workflow through our digitalization platform and take the next step with us towards corporate digitalization.